Why shipping cost is increasing massively in 2021?

The third quarter of the shipping industry will welcome the super peak season!

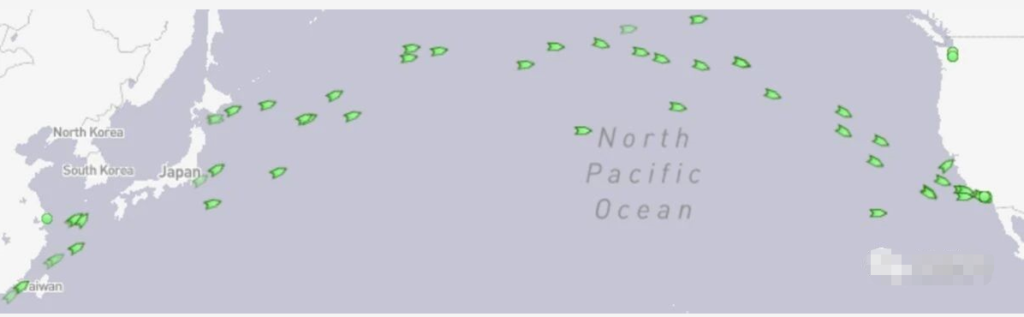

- South China Port resumes full operations, and at least 36 container ships are sailing from China to the United States.

- Although the shipping market is facing various problems caused by cargo backlogs, ship delays, port skipping and shortage of space this year, with the recovery of global trade, demand has soared, Europe and the United States have successively unblocked and opened up a mode of explosive purchase, and demand far exceeds the supply of capacity.

- The market entered the traditional peak season in the third quarter. Shipping prices and container volumes have risen, and new ship orders have also increased significantly. Industry insiders predict that the trans-Pacific container shipping market is expected to usher in a super peak season in the third quarter!

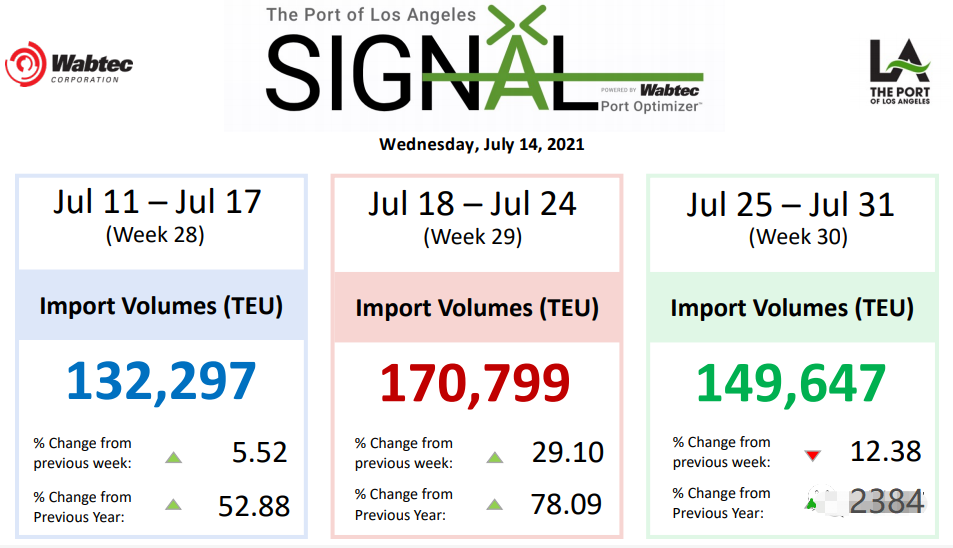

- The Port of Los Angeles in the West of the United States on Wednesday announced the best June data ever. It is expected that the cargo volume in July will be higher and the number of container ships berthed in San Pedro Bay will rise again.

- “The cargo continues to be transported at a record speed. There is no pause, no intermission.” said Gene Seroka, executive director of the Port of Los Angeles.

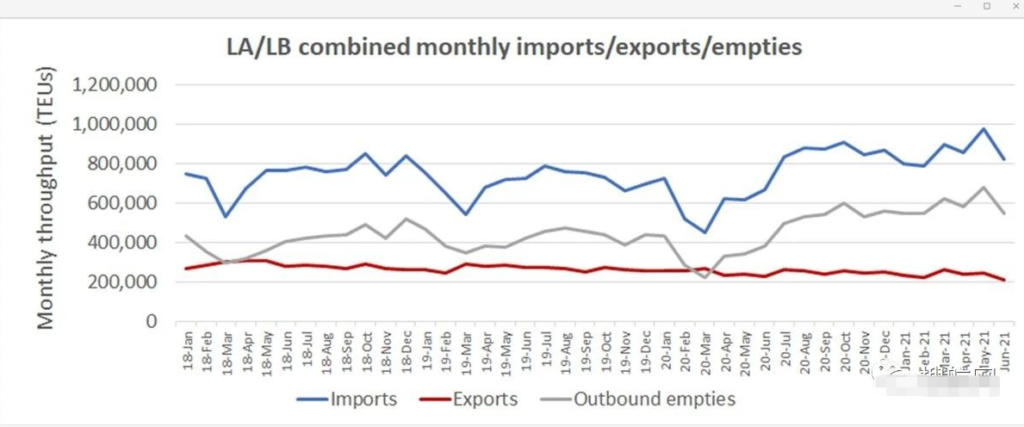

- The Port of Los Angeles reported that the total throughput of June including imports, exports and empty containers was 876,430 TEUs, a decrease of 13% from the monthly record of 1 million TEUs set in May. Among them, the import volume in June was 476,763 TEUs, which was also a drop of 13% from May.

- This is mainly due to the restrictions on the new crown pneumonia epidemic at major ports in southern China, which temporarily interrupted imports from the California port of the United States. Imported containers to Long Beach in June also fell by 20% compared to May, which is similar to the situation in Los Angeles.

Los Angeles/Long Beach Port Import/Export/Empty Container Throughput

- According to Seroka, “About one-third of the ships in the port came from Guangdong Province. Since Guangdong Province’s normal ship departure capacity was only about 50% at the time, the number of ships arriving in California in June slowed down.”

- The imminent challenge facing California ports is that all cargo that did not arrive last month is now late. “China’s South China Port fully resumed operations in late June, which means that more ships will sail to us this month and August.” Seroka pointed out.

July and August seems need stronger shipping demands

- Not only must we handle all the delayed arrivals of Yantian, but the traditional peak season will also increase simultaneously. “July and August look very strong…all signs are that the second half of 2021 will be very busy,” Seroka said.

- “We are now seeing seasonal products such as back-to-school season, autumn fashion and Halloween goods starting to enter the market, and we do expect some shippers to purchase year-end holiday products earlier than normal.”

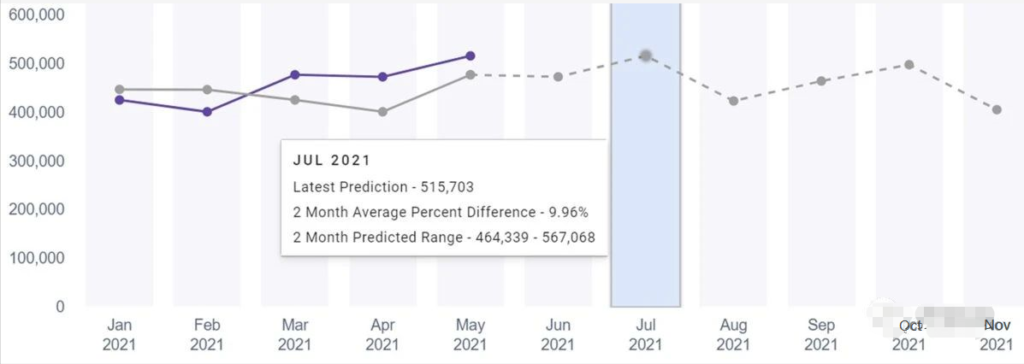

- According to data from Port of Los Angeles Horizon, a forecasting tool launched by the Port of Los Angeles, the tool uses algorithms to estimate future freight volumes. It is predicted that the total freight volume (including imports and exports and empty containers) in July will be between 950,000 and 1 million TEU, which is close to the monthly record level, while the freight volume in August will be much higher than 900,000 TEU.

- The forecasting tool estimates that imports in July will be 515,703 TEU. In 2021, the port is expected to handle approximately 10.5 million TEUs, which is 14% higher than the high reached in 2020.

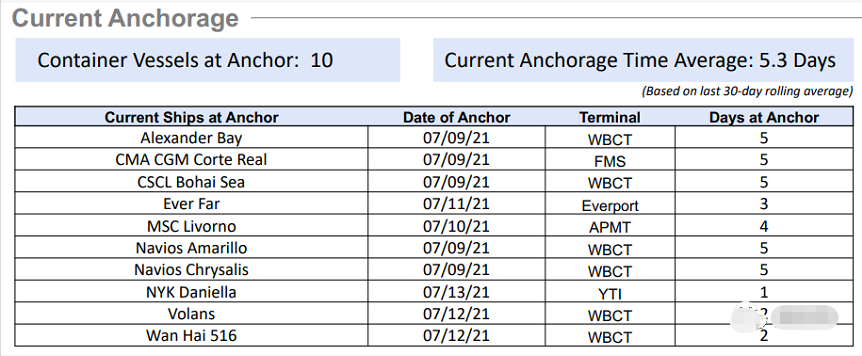

The problem of long staying time persists

- Los Angeles is entering the next phase of its freight peak, and the current cargo flow is still facing obstacles. Seroka emphasized: “We must continue to work hard to improve efficiency.” “Now all of our supply chain partners need to further increase production and speed.”

- He reported that the container stay time at the terminal continued to hover at the peak of 5 days. “The railroad running time on the terminal is about 12 days. Because the warehouse is full, the stay on the road in June is as high as 8 days. Most importantly, the continuous surge has put pressure on all nodes in the US supply chain, and we must change This trend.”

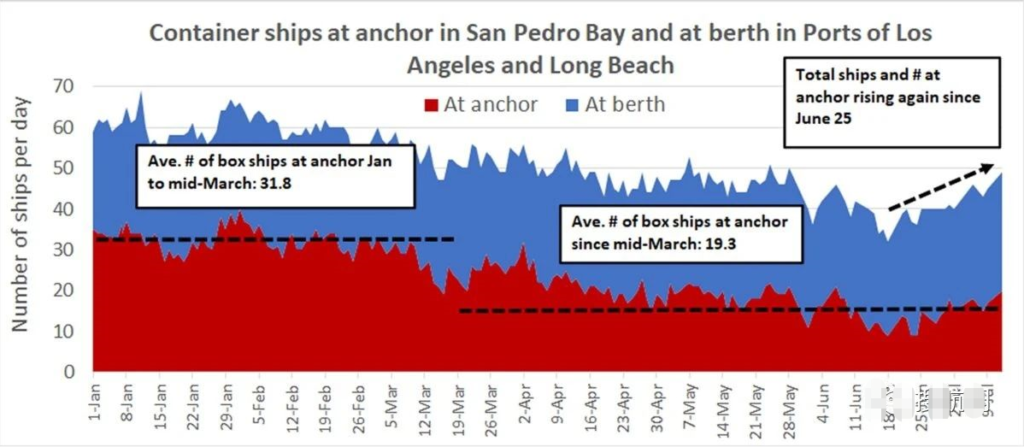

- Seroka said that on the positive side, only half of the ships that arrived in Los Angeles last month were directly anchored. “Compared with 90% of the ships directly anchored in San Pedro Bay in February, this is a significant drop. This is since October last year. The lowest percentage of the ship, when the ship first started to anchor.” The average waiting time in June dropped from the peak of 8 days in March to 5 days.

- But since the end of June this year, the number of ships at anchor has risen again. Seroka said: “We are now seeing more ships berthed, which may be related to the arrival of more ships after the South China Port resumes operations.”

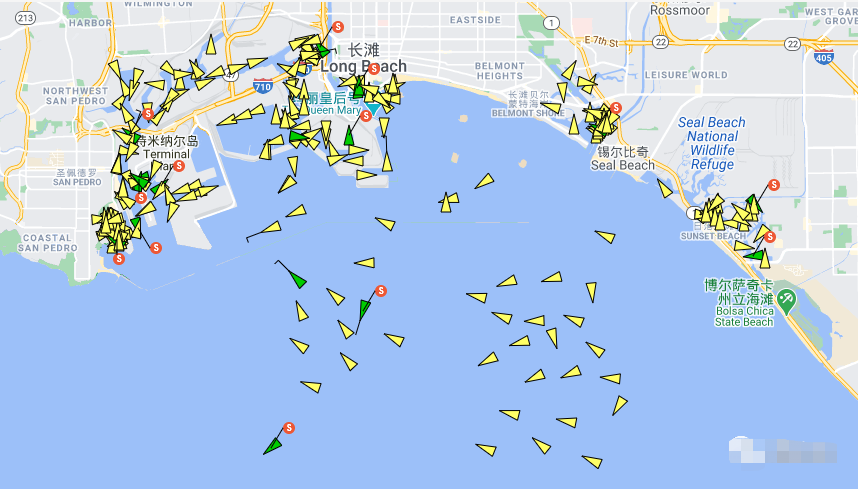

- According to data from the Marine Exchange of Southern California, the total number of container ships at berths in Los Angeles and Long Beach and San Pedro Bay anchorage rose to 49 on Monday, and the number of ships at anchor increased to 20. This is twice the total number of ships at anchor in the third week of June, when the number of ships at Yantian affected by the epidemic was limited.

U.S. import demand signals remain strong

The number of anchorage ships may continue to rise. MarineTraffic’s ship tracking data shows that at least 36 container ships are currently sailing from China to the United States.

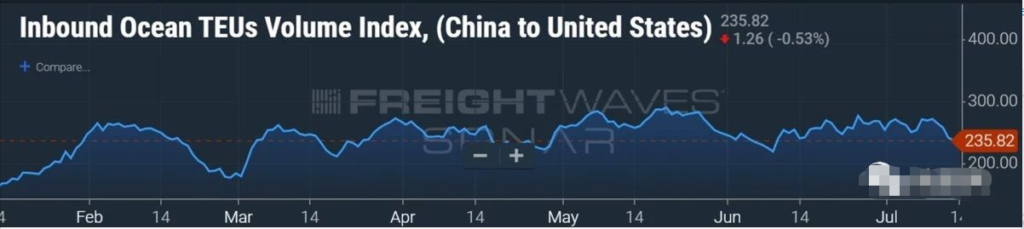

At the same time, FreightWaves SONAR’s exclusive booking index for Chinese goods shipped to the United States was still close to a high in mid-July, which means that the trans-Pacific eastbound freight volume will continue to remain high next month.

- It is widely predicted that as more people are vaccinated and service spending increases, Americans will reduce their consumption of goods, but this has not happened yet. Despite the increase in non-commodity spending, the retail inventory-to-sales ratio (excluding automobiles and auto parts) is still close to historical lows.

- “It’s clear that consumer spending in the US is still strong,” Seroka affirmed. “Even if the service sector recovers in spending on tourism, restaurants and ball sports, retail and e-commerce remain strong.