Can you buy dental saliva ejectors under USD 1 in 2021?

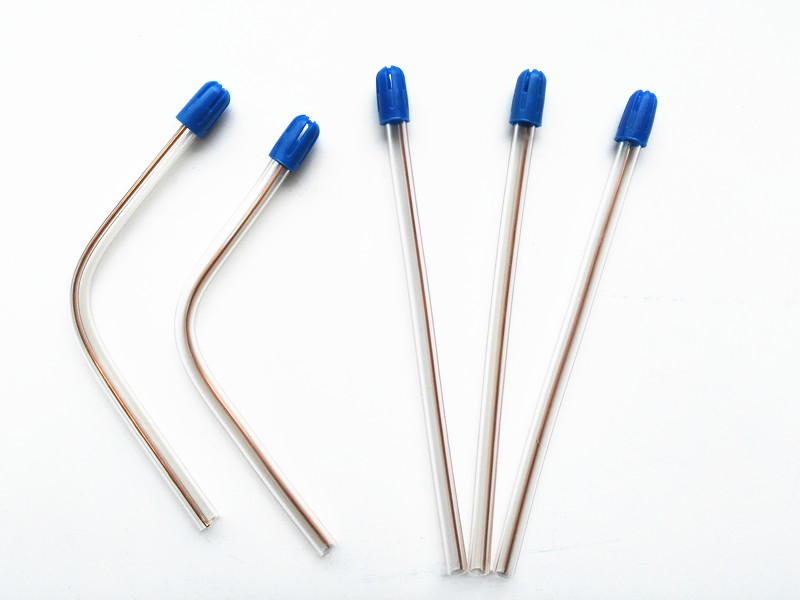

Dental saliva ejectors are made of PVC raw material, packed with 100 tips per plastic bag. It is widely used in dental clinics or dental hospital all over the world.

Many importers imported dental saliva ejectors at a good price around USD 1 before 2019 from China or Italy, sometime it was under USD 1 at that time.

Can you still buy dental saliva ejectors under USD 1 in 2021?

Obviously, The answer is very difficult and impossible. Let’s analyze the reason and know what happend.

Discontinued and limited production after Chinese Mid-autumn festival again! Seriously out of stock! The price of PVC has soared by RMB 1,450/ton! The manufacturer will not report price on closing! Some manufacturers: Just take a holiday…

If you ask who is the latest plastic star product recently?

It must be PVC!

The price of PVC has exploded!

It has skyrocketed by 15% in a single month, and there is still an upward trend!

Limited electricity and production, environmental protection and limited production, the plastic market continues to be tight, downstream factories are seriously out of stock, and many plastic companies have simply put on holidays.

PVC futures soared 4.21%! Crude oil prices continue to rise!

On September 23, 2021, international oil prices rose slightly. China domestic crude oil futures 2111 rose 1.87%, PVC2201 soared 4.21%, PP2201 soared 2.49%, PTA2201 rose 1.85%, and plastic 2201 rose 0.74%. Plastic futures can be said to be rising in full swing!

Futures rise, how could the spot not respond? The spot pvc rose more violently than the futures.

PVC spot soaring! Some manufacturers will not report offer after closing the disk!

Recently, many provinces and cities have been affected by power restrictions and the production of calcium carbide has been affected. The daily output of calcium carbide in the country has decreased by more than 5,000 tons. Affected by this, the ex-factory price of PVC has risen sharply. Due to power restrictions, the production load of some enterprises has declined, and the market will not be reported!

Sichuan Jinlu: About 70% of the PVC plant started, and the quotation on September 24 was increased by 300 yuan/ton. The current price of calcium carbide 5 type is reported to be 10,800 yuan/ton by wire transfer, and the 3/8 type is high by 200 yuan/ton. The actual order can be negotiated.

Inner Mongolia Yili: 80% of the 500,000-ton/year PVC plant is currently under construction. On September 24, the 5 type price was 10,700 yuan/ton.

Suzhou Huasu: The 130,000-ton PVC plant has returned to normal. The pre-sale completed in September is progressing well, and the 800/1000/1300 model will not be reported.

Gansu Yinguang Chemical Industry: The 120,000-ton/year PVC plant will be overhauled on August 27. The original plan was for a period of 20 days. Currently, it is temporarily planned to drive this weekend. The company has no inventory, and the factory does not offer quotations.

Formosa Plastics Ningbo: 400,000 tons of PVC equipment is in normal production, and the pre-sales of the enterprises are the main ones. The vinyl materials S60/65/70 are not quoted for sealing.

Hanhua Ningbo: The 400,000-ton PVC plant is under normal operation. The company’s pre-sale is in October, and orders are received within the time limit. All brands are closed and not reported.

Qilu Petrochemical: The 360,000-ton PVC plant will be shut down for maintenance on July 31. The start-up time has been postponed, and the offer is not currently available.

Baotou Sea Level Chemical: The PVC plant has been under-operated since July 17th, and the current operation is 50%. The recovery time is yet to be determined. The new price has not been issued in the factory.

Taizhou Liancheng: The output of the 600,000-ton PVC plant was reduced by 70% due to the impact of electricity, and there is no inventory. The sales of 60, 70, and 65 grades are closed, and the offer is negotiated.

Dezhou Shihua: The 400,000-ton PVC plant has not started much. Today’s price increases by 500 yuan/ton, the calcium carbide method 7 type implements 11,700 yuan/ton acceptance self-withdraw, and the 8 type implements 11,700 yuan/ton acceptance self-withdraw. On this basis, the spot exchange price is 100 yuan/ton lower.

Henan Haohua Yuhang Chemical Industry: About 70% of the 400,000-ton PVC plant was started, the price of PVC was raised, the price of type 8 was 11,700 yuan/ton, and the type 5/3 were temporarily out of stock.

PVC manufacturers are either skyrocketing or out of stock, and the market price is also rising:

September 23 2021:

PVC Incumbent 5 type rose 450 yuan/ton to 10880 yuan/ton

PVC Zhongtai Type 5 rose 450 yuan/ton to 10880 yuan/ton

PVC Tianye 5 type rose 450 yuan/ton to 10880 yuan/ton

PVC Salt Lake 5 type rose 430 yuan/ton to 10780 yuan/ton

PVC triple 5 type rose 430 yuan/ton to 10780 yuan/ton

On September 1, the market price of PVC/Shaanxi Beiyuan/SG8 was 9650 yuan/ton, which was more than half a month, rising by 1450 yuan/ton. On September 23, the market price reached 11100 yuan/ton. At present, there are many places in China. Electricity restrictions have led to insufficient supply of calcium carbide, the main raw material of PVC, and the market is worried about the tightening of supply. The double festival is approaching China domestic downstream and just need to purchase. The price of calcium carbide ethylene method PVC has increased by more than 400 yuan/ton. Means: Please inquire before placing an order!

Double control policy, thousands of companies stop production and limit production

On August 17, the General Office of the National Development and Reform Commission from China issued a notice on the “Barometer of Completion of Energy Consumption Dual Control Targets in Various Regions in the First Half of 2021”. Decrease and rise, it is a first-level warning. The notice requires that all localities remain highly vigilant to the severe energy-saving situation in the first half of the year and take effective measures to ensure the completion of the annual energy consumption dual control target, especially the energy consumption intensity reduction target task.

The power shortage and the policy of “dual control of energy consumption” affect the continuous fermentation. The “red light” of dual control of energy consumption in many places in China has been lit up. In less than four months before the year-end “big test”, the areas “named” by the Ministry of Industry and Information Technology have successively taken measures to improve the energy consumption problem as soon as possible. Major chemical provinces such as Jiangsu, Guangdong, and Zhejiang are even more aggressive, taking measures such as suspension of production and power outages on thousands of companies, making local companies caught off guard.

Zhejiang: A major textile town issued a power outage notice, covering 161 companies.

Jiangsu: The printing and dyeing cluster area issued a production suspension notice, and more than 1,000 enterprises “opened two and stopped two”.

Guangdong Province: Start two stops and five stops, and only retain less than 15% of the total load.

Yunnan: The average monthly output of industrial silicon companies from September to December is not higher than 10% of the output in August (ie a 90% reduction in output); the average monthly output of the yellow phosphorus production line from September to December shall not exceed 10% of the output in August 2021 ( That is to reduce production by 90%).

Inner Mongolia: From 2021, coke (blue charcoal), calcium carbide, polyvinyl chloride (PVC), synthetic ammonia (urea), methanol, ethylene glycol, caustic soda, soda ash, ammonium phosphate, yellow phosphorus will no longer be approved… without downstream conversion New production capacity projects such as polycrystalline silicon and monocrystalline silicon.

Shaanxi: From September to December, the newly built “two highs” projects are not allowed to be put into production, and the newly built “two highs” projects that have been put into production will have a basic limit of 60% in August. Other “two highs” enterprises implement reductions in production line operation load and stop operations Measures such as limiting the production of submerged arc furnaces have ensured a 50% reduction in production in September.

Such a large-scale production suspension and production restriction has brought about a supply-side tightening, resulting in a sharp increase in the price of plastic raw materials, and the severe situation has made upstream and downstream companies restless...

Although there were power cuts across the country in December of last year and May of this year, the scope and length of the power cuts did exceed many people’s expectations. In particular, many companies have relatively flat orders. The Mid-Autumn Festival simply puts on a long holiday, but they did not expect to encounter a wave of production stoppages after the festival. Watching the prices of raw materials go up, the bosses are completely awake.

Due to the concentrated production capacity of upstream raw material manufacturers, they are relatively in advantage. Faced with prolonged downtime, prices are bound to rise. However, the manufacturing companies in the middle and lower reaches have only passive acceptance in the face of rising raw material prices due to their large numbers and decentralization.

In the past four months, the Chinese economy has experienced a difficult situation in which the gap between PPI and CPI has reached new highs. At this time, while consumption is still sluggish, the rise of raw materials against the trend is bound to crush the middle and lower reaches of the industry. Especially for some small and medium-sized enterprises, their living conditions are worrying!

Some bosses heard that their own companies must “open one day stop six days”, and lamented: factory rent, labor, delivery, and tax payment are not allowed to “open one day stop six days”, but production must “open one day stop six days”, which makes small and medium-sized enterprises how to survive…

After knowing the situation in China, You can learn that why saliva ejector price increased in 2021.

Will PVC continue to increase in price?

Yes, at least end of 2021. PVC will still increase that may cause dental saliva ejector price increase again.

Welcome to compare our saliva ejectors price and quality with others.